Albert Einstein is credited with saying the following about compound interest: “Compound interest is the 8th wonder of the world. He who understands it, earns it…. He who doesn’t, pays it.”

The truth is no one really knows if Einstein really said this. But regardless of if he did or didn’t, the words contain valuable wisdom. And if you understand them and — more importantly — apply them, you can create a bright financial future.

First, the basics.

Interest can be calculated two ways: simple and compounding.

Simple interest is calculated by applying the interest rate to your principal only. For example, if you invested $10,000 in a vehicle that pays 5% interest annually, you would receive $500 in interest at the end of the year. The next year, if your $10,000 were reinvested again at 5% you would receive another $500. And if you reinvested it again you would receive another $500 — a total of $11,500 after three years.

Compound interest is applied to both your principal and the interest earned. You are getting interest on your interest as well as your principal. For example, if you invested $10,000 in a vehicle that pays 5% interest annually, you would receive $500 at the end of the year. So far, there is no difference from simple interest. But things change the next year. Instead of applying interest to the principal only ($10,000), interest is calculated on $10,500 — both the principal and the interest combined. So at the end of the second year, you would receive $525 as opposed to only $500. And if you reinvested the principal and the interest again — this time $11,025, you would receive $551.25 at the end of the third year. This would be a total of $11,576.25.

This doesn’t sound like a lot a first, but the compounding would continue as long as you leave your investment untouched. After 30 years using simple interest, your investment will grow to $25,000. But using compound interest, your investment will grow to $43,219.42. That’s a profit of more than $18,000 through compound interest alone.

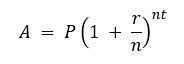

Here is the mathematical equation for compound interest.

Where “A” is the final amount, “P” is the principal (initial investment), “r” is the interest rate, “n” is how many times per year interest is compounded, and “t” is how many years the money is invested.

Don’t worry. You don’t have to do the calculations yourself. A financial calculator will do all the work for you, and there are plenty of free ones online.

Let’s look at each element. The principal is the amount of your initial investment. Obviously, the more you have to invest, the greater the expected return because you will have more money working for you. Interest rate is the rate of return on your investment. This will vary depending on the type of investment, the interest rate environment, and market conditions. The frequency of compounding is how many times per year your investment will pay a return that is reinvested. It could be annually, semi-annually, quarterly, monthly, or daily. The more frequently it pays, the better. Finally, and most importantly, is the number years your money will be invested. An increase in any one of these factors will increase the potential return of your investment.

The benefits of compounding can be applied to any type of investment including stocks, bonds, mutual funds, exchange traded fund (ETFs), money markets, certificates of deposit (CDs), and saving accounts. Your returns could be in the form of interest, dividends, or capital gain distributions.

To take advantage of the power of compounding interest, I recommend doing the following:

- Invest now. Time is your most valuable asset. You can never get it back. Once it’s gone, it’s gone. And time has the greatest impact on you your potential return. Invest now even if the amount you have is modest. Don’t waste your time, it can cost you.

- Make regular contributions. Make it a priority to save and invest a percentage of your income consistently. Pay yourself first. Treat your savings plan like a monthly bill. The more you can add to your principal the better.

- Set up your accounts for automatic reinvestment. If you own individual stocks, your firm may allow you to set up your account for dividend reinvestment. This automatically reinvests the dividends back into the stocks you own. You can do the same for your mutual funds and ETFs. They pay both dividends and capital gain distributions that can be reinvested. If you own CDs, you can have your bank automatically purchase a new CD when they mature.

- Invest through tax-deferred accounts. Interest, dividends, and capital gains distributions are typically subject to income tax even if they are automatically reinvested. That’s right. You may still have to pay a tax bill even if you don’t touch the money. However, there are tax deferred accounts available depending on what you are investing for. They allow you to defer the taxes so you can keep the money invested. For example, if you are saving and investing for retirement, you can do so in an individual retirement account (IRA) or a 401(k) plan with your employer. If you are saving for education, there are 529 Plans and Education Savings Accounts. Just make sure you follow the IRS rules.

Beware! The power of compound interest can work against you, too. It definitely will if you have too much debt. Especially credit card debit. If you don’t pay off the balance in full, interest is charged on the outstanding debt and it is compounding. If you only make the minimum monthly payment on your debt, it will take a very long time to pay it off. Depending on the size of the outstanding balance, it may take years. And if you continue to use the credit card, you may always have an outstanding balance. As long as you do, interest is compounding against you.